Friday, December 5, 2014

Monday, December 1, 2014

Market update

VST/ ST - Sell

IT - turned to Sell as of close today

LT/ VLT - Buy

Gold update

IT turned to Buy

Thursday, November 20, 2014

Tuesday, November 18, 2014

Market update

Previous market update here

VST/ ST - New buy signal

IT/ LT/ VLT - Buy

Previous sell signal was a fail = This ST/ VST updates could be chop and top/ drop. Trading portfolio is getting chopped. But, IT remained a buy signal through out, so we are better in that account.

Except internals (Breadth and other liquidity indicators), everything in the externals are firm including price structure. Breadth has been bad for the last 2 months, indicating topping. In 2007-2008, it took 3 months for the price to realize bad breadth. But, in 1998 - 2000, it took 2 years for the market to eventually top. Bad breadth continued to push the market higher from 1998 to 2000. So, there is no telling if the market will top tomorrow or in 2 years. Our barometer has not given a signal either, so wait for IT change in stucture, not yet at least!

Internals are obviously bad, so be prudent; Be flexible; Signals may fail, signals may be profitable but be advised to be change your mind at the hint of change in direction.

Thursday, November 13, 2014

Market update

VST/ ST moved to sell

IT/ LT/ VLT - Buy signal

Previous market update here, stopped out.....

Didn't take the next buy signal

Tuesday, November 4, 2014

Market update

ST turned to sell

IT/ LT/ VLT - Buy

Previous update here

Just FYI, to see if you noticed or not, on the eve of this mid-term elections;

Market - Highs

Economy - GDP/ PMI/ etc - Good

Employment - Good

Gas prices - @ 4 year lows

= All feels good

^ Funfact, nothing else. GLTA!

p.s: On a sidenote, we expect crude oil to be bullish for the next 2 years; But, we will only follow price trends and not expectations

Wednesday, October 29, 2014

Market update

Previous market update here

No change from that previous update so far

but but but.....

We have a so called FOMC day today. I posted our guidelines on what we do on FOMC days here .

Hence, we go into the day rather flat, with very light positions with the buy signals on. The last many days have been very favorable to us, so it does help to lighten the positions. The rally may continue ferociously upward into 2200 SPX :) , we have no idea to predict the future but that shouldn't matter much. I will use the next signal to trade with the normal size positions.

GLTA!

Wednesday, October 22, 2014

Market update

VST - on a sell today (ignore = no positions)

ST - Still on a buy at close today

IT Turned to buy yesterday

LT/ VLT - Buy = no change

I expect SPX at ~1965 by the end of this month, it means I have a higher target upwards.If you are looking at daily charts and go long, today was such a day. 2.5% stop on IT signals, VST/ ST = get out with profits

Previous update here

Thursday, October 16, 2014

Market update

Tuesday, October 14, 2014

Market update

Previous market update here , no change as of now.

I don't see any bottom in the charts right here. Yesterday morning, the market tried to rally but failed miserably. The afternoon sell off was vicious. I see signs of atleast July/ August 2011 (if not more dangerous markets) when I go through the charts. It will be a miracle for the markets to bottom right here, right today. Price is king, but how will the price bottom when there are no indications at all? Bear markets come with bull traps, so beware.

One of the barometers I use (chart below) is still on a sell, but shows indications of a "near" bottom. Near = doesn't mean today! Near means we are close to it, in time. Not price. The last drop that could be squeezed from the bulls can be big and violent. Hence, don't try to define the future. Just follow the trend.

If you have any questions on this chart, send me a message or reply below. Good luck!

Friday, October 10, 2014

Market update

VST/ST/IT - Sell

I remain in cash till this wicked chart resolves.

I stopped out of my long positions 1% into my buy entry yesterday. This is the 2nd time this year that we got a big sell off (like yesterday) right on the day after we got a buy signal, I admit.

Thursday, October 9, 2014

Market update

As of close yesterday,

VST/ST - Buy

IT turned to buy , use a 2 - 2.5% stop

Previous IT buy was profitable as I used scaling out.

If you are trading my signals, use my methodology. Please.

Previous update here

Wednesday, October 8, 2014

Tuesday, October 7, 2014

Market update

Previous update here

Last week, I have read many traders say that was the bottom. We thought there was more downside to come which we are seeing today.

ST turned to Sell (hope you took profits at the right time following our methodology)

IT remains on Sell but I see signs of bottom but we follow price (Resistance is SPX 1945)

We will be following VST buy signals from here as turns are important

Till then, GLTA!

Friday, October 3, 2014

Market update

Quick update as I am travelling right now

ST turned to buy as of now - taking positions

I still think we have some downside left but we will follow the price.

IT (daily chart) - on Sell

Previous update here

Thursday, September 25, 2014

What next?

This blog post comes after a big down day for the market = 1.62%. We remained short going into the day even after yesterday's good rally. I closed VST/ ST short positions (read 5 under timeframes ). I still remain short on the IT position but took 1/3 off the table, following my scale out principle. The market basically boxed swing traders for the last 2-3 weeks, harassing us in the VST/ ST signals = all fail. One day like today compensates for the small losses we had in the last 2 - 3 weeks; actually not only compensates but makes the account positive for the last few weeks.

Anyway, what is next? What is the direction going forward? I don't know. All I do is to follow the trend. How long this downtrend lasts? I don't know again. However, I see signs of the last phase of this down trend. One of the signs is in the chart below. We are entering an area where this chart indicates bottoming of the market. The last time I posted this chart was then . Of course, the market did rally few days later. Unless the market structure changed (from bull market to bear market), this barometer should still do good. I am not just talking from this chart's point of view. I have few barometers which are showing the same signs of bottoming. Bottoming could take few days. There may be divergence sometimes. We don't know. What does it mean to us, traders? We don't have to buy everything like crazy. Why? Price still rules. If market swings wildly, if market takes you off the rider, if you have doubt that market is going to turn, if you think you have earned good profits = fine = remain in cash till the signals change again to buy. But, please do not start buying before the market turns, that is not how it works.

Resistance is SPX 1978. Support should be around 1940 area. More to come in the next post....

Tuesday, September 23, 2014

Market update

VST/ ST/ IT - Turned to sell as of close yesterday

LT/ VLT - Buy

We can use today morning's bullishness to sell short SPX. Previous market update here

Monday, September 22, 2014

Market update

In my previous post, I indicated that we were rather flat going into FOMC. So, we did not participate in the rise and decline of the markets since.

Previous market update here

If you followed the previous market update or if you followed my FOMC post, you should still be good (= market did not move much either way since 1 week) and be unscathed. I closed most of my holdings prior to FOMC, so I had a 1% profit on the previous IT signal. What now?

Market update

VST/ ST on a buy

IT turned buy on 09/18 close (today's weakness should be good to initiate a buy with a stop...)

VLT/ LT - Buy

I am stressing on the stop this time because the breadth is very weak in the market. While we are still on a buy on all timeframes, this uber bullishness could turn into a disaster. Then, we could simply sell short and wait, right? Not really. We do respect price, hence we follow price. However, it helps to look around what breadth is doing to be cautious.....

Gold update

VST/ST/IT/LT - Sell

VLT - changed to Sell but we will wait till month end for confirmation

Gold update

VST/ST/IT/LT - Sell

VLT - changed to Sell but we will wait till month end for confirmation

Have a good trading!

p.s: I do not have any positions on BABA now but I did daytrade on the IPO day few times for a 1% net gain on the account (not BABA position)....

Wednesday, September 17, 2014

FOMC Forecast

If you look at the economic calendar, there is an important announcement every single day of the week. While they may be important, I do not care for most announcements = I do my own trading based on the market technical regardless of what the outcome may be from the announcement. However, there are some very important market moving events like FOMC meeting announcement. We need not read all what is published on the announcement, as we can seldom trade markets based on announcements. In other words, the outcome of these announcements will manifest on the technical charts very soon = we begin trading at that time.

What do you do before, and after the FOMC announcement though? Like I said above, FOMC is noise to me. But, the noise can hurt us sometimes. The noise can throw the technical out of the charts, before, while and shortly after the announcement. I have seen traders say "this is a trader's paradise". If I traded on FOMC days in the past, I had mixed results with gains sometimes and losses sometimes = ineffective. Hence, I have learnt to stay out of the market starting 1 day before the FOMC announcements till 1 day after. If I participated, then it would mean I had small positions which would not impact my accounts much. I could be in the middle of a good trade which I may lose if I get out. Unfortunately, we may feel so sometimes that we shoulda participated in XYZ trade. In the big picture though, it helps to stay out of the noise. It kinda feels like fun to be the audience when every single media outlet and every trader/ investor is pretending to be panicky after the FOMC. If possible, I get the front row seats = listen to Bloomberg/ CNBC. It doesn't hurt to just enjoy the weather outside on such days though.......= take a break!

Happy FOMC day for all market participants!! :))

Wednesday, September 10, 2014

Q & A

1. Your signals are conflicting

A. There are always different trends in the market. If you look at the hourly charts, you may say the market is flying but the daily chart may say the market is breaking down. The market always has different time frames. Your trading basis/ bias should also have different time frames. I have 3 different accounts catering for different times frames and different goals. What your time frame is, depends on your risk, goals and needed returns. You must define these 3 before you even start trading, before you start following (your/ someone else's) signals. Then, you search for a proper instrument in the market.

2. Your signal is a fail

A. That is correct. If my signal always works, I would be a billionaire by now with a Year over year % returns of >1000%. I am not. My returns are decent in all timeframes and consistently beat the market. I see that they are positive in all time frames. Importantly to answer the question, my signals are profitable most of the times. Sometimes they do fail, I agree.

3. So, how do you prevent a big loss?

A. Risk sizing is very important. If the market acts erratically, if you met with an accident (and did not trade for few hours/ days), if something unthinkable happens and the trade goes against you - you should still be in a situation that your account will survive. You can always win tomorrow, but surviving till tomorrow is the key to trading. Hence, you should adjust your position sizing to reflect your risk/ survival etc.

When you take a signal, it is always important to think how much loss you can bear for a position.

I prevent big losses so that my account will survive the unthinkable. However, things do go against me but I keep such incidents to very very few.

4. What should you do?

A. There is somethings called using stops. And there is something else called following a methodology. Before following me, I suggest you to go through my thought process and methodology. It doesn't matter if you subscribe to paid investment analyst/ guide, you still have to think what their plan is. Unless someone takes your money into their hands and works for you, you must use appropriate thought process.

Then, there are stops. Like I said above, you should review your risk, and adjust your stop in case the position goes against you. You must use manual / autostops for all your positions. If the position goes completely against you and the position opens higher/ lower, unfortunately you still close that position. There is always tomorrow to work on your next profitable trade.

5. How is your performance decent if you hit stops often?

A. We must make sure that the number of profitable trades are more than the number of losing trades. Position sizing again plays a role. If you use all our account into one trade and that trade goes against you, you cannot withstand the fear and will dump that position out of panic too soon = You won't give the trade, enough time to work for you.

6. What timeframe is most profitable for me?

A. Market conditions are not always the same. When volatility is very high, traders profit a lot. In 2011, my trading portfolio had a return of 44%. Sometimes, investors gain nothing. In 2012, my long term portfolio had returns of 3% (vs SPX return of 0%!!). In 2013, When volatility is low, traders loss money to brokerages via commissions while swing traders are king. So, the portfolio performance depends on volatility of the market.

Labels:

goal,

loss,

methodology,

position,

profit,

return,

risk,

size,

stop,

Time frame

Tuesday, September 9, 2014

Saturday, September 6, 2014

Market update

ST/ VST - Turned to buy as of close on 09/05

IT/ LT - Buy

Previous update here

Our previous sell (VST/ ST) yielded some downside (to the 1988 SPX area) but wasn't good enough to capitalize on it, hence we got stopped out higher = loss. No problem, as it was only a 8 point loss.

Gold update

ST/ VST on a buy

IT/ LT - Sell

Wednesday, August 27, 2014

Monday, August 25, 2014

Market update

VST/ ST - Turned to buy

IT/ LT/ VLT - Remain on buy

Did not get anything out of the previous VST/ ST Buy

No change in the Gold update.....

Friday, August 22, 2014

Market update

ST/ VST - Turned to Sell

IT/ LT/ VLT - Buy

My barometers are saying this is a "Buy the dip" , unlikely that IT/ LT will turn to a sell but we will let the price dictate!

Gold update

ST/ VST - Buy

IT/ LT - Sell

Friday, August 8, 2014

Wednesday, August 6, 2014

Market update

Good morning Trader, How is you?

I have taken a good break for a couple of months. I did miss a couple of market swings, but I was working on other important opportunities for myself. So, I didn't miss anything for not trading for the past 2 months. I got back couple of weeks back, I took time to settle into a rhythm, I traded on paper for 2 weeks. I am ready for new trades.

The market hasn't gone anywhere in the last 1 1/2 months. In the market, there are going to be phases like this. Hence, even if you are a market trader (trading /ES or SPY or QQQ...), you will benefit if you trade some other stocks with high volume, big market caps, no/ low news tickers. Every single ticker doesn't always rhyme with the market.

Market update

VST/ ST/ IT/ LT - on Sell obviously (no positions)

VLT - ticked to Sell right now but too early as we are only in the 1st week of the month, things can change by the end of this month

For definitions of my time frame terms - click here

We are on sell mode in all time frames, things look gloomy, huh? If you are already on the short side, hold on! I do not suggest new positions in the middle. I am looking for a turn, however. Few of my barometers have been suggesting a turn (one below in the chart) but price is king and indicators are queen. Barometers like the below only suggest me that a possibility of a turn is possible, but no guarantees till the price turns.

I have posted this chart few times in the past to pick tops and bottoms. At this point of this barometer, it can be said we are forming a bottom. It doesn't mean you exit your current positions. It means that you should be on alert for the possibility of an exit/ scale out of your current (short market) positions.

Gold update

VST - Buy

ST - Turned to buy at 9 am EST

IT - Sell

LT - Buy

VLT - Buy

Friday, May 16, 2014

Market update

Previous market update here

VST/ ST - Bearish

IT - Turned bearish as of market close yesterday (stopped at 1880 SPX long)

LT - Still bearish

VLT - Bullish

I am short SPX right now with adequate chops. That's not a typo, but I meant 'stops' haha. The April - May period every year is full of chops and stops get hit relentlessly. In the my 2013 annual report, I did note the April chops effecting portfolios.

I am short right now but I am doubtful of this decline, let's see. I am watching the options market everyday after close. While $CPCE is in Bearish territory (>0.75 in the bottom indicator) (chart below) ,

it also means that a close below that 0.75 means we are bullish again. If you keenly observe the chart, a rise above 0.75 and close below marks the bottoming process. The process could take a while, we have no idea till confirmation. I would always have 2 positions (trading on the basis of hourly/ 4 hourly charts and swining based on dialy charts) for this reason. I select 2 different instruments if I am in a bipolar mode. And often times, it does work well for me.

If you keep your risk under control, regardless of chops/ stops, you still emerge a winner in the annual horizon. Good luck to you!

Wednesday, May 14, 2014

Market update

VST/ ST - Turned Bearish (not taking this signal)

IT - Bullish (bought SPX at 1889 on 05/12)

LT - Turned bullish but waiting for the week to close for confirmation

VLT - Bullish

Previous update here

I was stopped out of VST/ ST/ IT bearish positions on 05/09 at SPX 1880.

This market grind is chopping both bulls and bears for the last 1 month in all indices and commodities. A breakout has not yet been established in any form of the market.

GLTA!

Friday, May 9, 2014

Thursday, May 8, 2014

Update

Based on the update here .

Usually I don't post VST/ ST trade updates since it is already implied at open that we either close on "adequate" profits (VST & ST trades I mean) or get stopped out. Unfortunately, I got stopped out on ST trade that I opened today morning= small loss.

I didn't get the next signal turn yet on ST trade, so we stand at

ST - Bullish (stopped out), no turn signal yet

IT - Bearish

LT - Bearish

VLT - Bullish

The market hasn't closed yet for today; so if there are any changes, I will add in the comments section at EOD.

I took profits on the TSLA 190/180 vertical put spread at open today. Good luck trading!

Market update

Previous update here

ST - Bullish

IT - Bearish

LT - Bearish

VLT - Bullish

Sure is one hell of a market to trade, I agree. Take your profits, exit; Rinse repeat....unfortunately not so easy!

Wednesday, May 7, 2014

Update

Based on market update and methodology , taking half off ST positions at 1.5%. The other half will be closed at signal turn. GLTA!

Tuesday, May 6, 2014

Market update

Previous update here

VST, ST - Bearish

IT - Turned Bearish as of close today (Previous signal to signal yielded 23 SPX points)

LT - Bearish

VLT - Bullish

Timeframes and trading methodology here

Friday, May 2, 2014

Tuesday, April 29, 2014

Market update

Previous update here

VST/ ST - Bullish (turned now from bearish)

IT - Bullish

LT - Bearish

VLT - Bullish

Sunday, April 27, 2014

Gold update

Previous update here

VST/ ST/ IT - Bullish (Daily charts turned bullish on Friday)

LT - Weekly charts still bearish...

VLT - Bearish

Last many weeks gold has been chopping both bulls and bears.....

Friday, April 25, 2014

Market update

Previous market update here

VST, ST - turned Bearish

IT - Bullish, hold

LT - Bearish

VLT - Bullish

We have closed VST, ST positions earlier this week. We do not wait for the signal turns to close ST/ VST positions. Read our "Introduction" section above, for better understanding of our methodology. IT positions have a 3% stop from open. This ST bearish turn could easily become a IT bearish position, I will update when that happens. GLTA!

Sunday, April 20, 2014

Market update

Previous update here .

VST, ST - Bullish, hold

IT - Turned bullish as of Thursday's close (stop 3% below Thursday's close)

LT - Bearish

VLT - Bullish

We traded the gyrating ups and downs of the market swings very well. I, infact tweeted live all my moves. I expect the market to continue to be volatile, I expect much downside or at best choppy. But, since I will only take my signals and not let my bias affect my trading, I will disregard the "general talk". I will update any changes in the market directions. GLT All!

Saturday, April 19, 2014

Gold update

Last buy was at 1285$, check this update for previous comparison . We have been tracking that chart for several weeks now. I have had a Intermediate target of ~ 1550$ based on that chart and my signals. This week we had a turn on our IT and LT frames. I have a sell signal on daily and weekly time frames right now on Gold from a buy previously.

The best case for a bull right now is that we could be a in a chop. Unfortunately, I will take my signals. My stop is ~ $1,350. GDX is in a much worse position, BTW, obviously due to the recently sell off in the equities.

All timesframes - Sell

Tuesday, April 15, 2014

Market update

Previous update here .

VST - turned bearish this hour

ST - Still bullish, losing steam

IT - Bearish

LT - Bearish

VLT - Bullish

GDX, GLD, /GC

VST, ST - Bearish

IT - Bullish but on edge

LT - Bullish (next update will be at end of week, last LT buy was at 1285 - /GC with a 3% stop)

VLT - Bearish

Monday, April 14, 2014

Market update

ST & VST & Very Long term - Bullish

Rest of the time frames - Bearish

Saturday, April 12, 2014

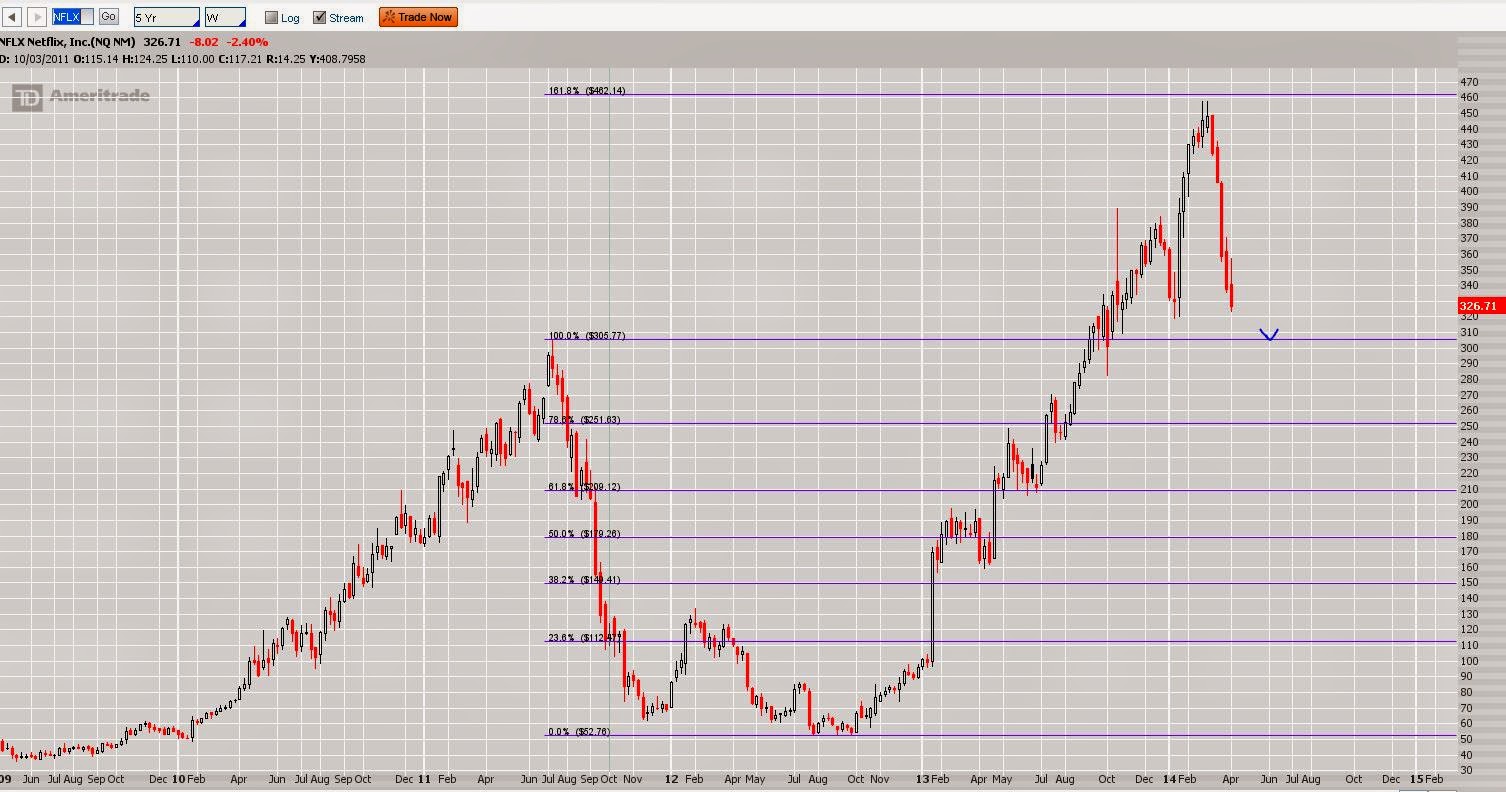

Netflix Inc. & Tesla

From the above Fib sequence charts, it should be very clear what the 1st targets for the current trend are. TSLA had a slight overshoot in its frothiness at the 161.8. Trend change before the support lines? I highly doubt it. But, will keep you informed if trend changes.

Friday, April 11, 2014

Questions and answers

I have had 2 questions from my stakeholders, very important ones: One was about GDX and another about yesterday morning's market update.

1, On Wednesday, my analysis indicated a buy signal for the markets. Yes, it did - based on the 4 hrly charts and the daily charts. My update also indicated a hourly sell signal. Absolutely contradictory. I manage 3 portfolios. One for the long term, one for the swing trading, and another for frequent trading. I understand your question, as soon as you read this - not everybody has 3 types of portfolios in their account, especially the small trader. Unfortunately, swing trading (on daily charts) has not been very good in this "bull market". I could not beat the SPX last year, only because my swing trading portfolio underperformed. I am not alone in this regard. If you look at any hedge fund, they all say it is a tough market environment to invest. One day the market is up 2%, the next day down 3%, it goes on and on. Is the market moving so much in the weekly horizon? Not so much!!! But, for those of us who are trading the daily charts, it has been tough. Really tough. On the other hand, trading (on hourly charts) has been excellent, especially with these wild swings. The Intermediate and long term trading (weekly and monthly charts) has been very good as well. Unfortunately, that has been the name of the game. Anyway, right now as of market close yesterday, all timeframes except the VLT are on a sell.

2. Someone asked me few weeks ago if GDX is better than GLD or viceversa. At the beginning of this year, I forecasted that both will outperform the market. And yes, they did (chart below). I have also noted that GDX will outperform GLD. Unfortunately, that has not been the case even while GDX has significantly been up for the year. The main reason being GDX is a basket of Gold mining stocks. Obviously, the stocks trade along with the general market trend. If market conditions are unfavorable to be bullish, and Gold charts are bullish, I would go with GLD or /GC (future traders). Not with GDX.

With the market being brutal/ choppy, if you maintain some rules on a strict basis, you should still come out with gains from time to time. Good luck again!

Thursday, April 10, 2014

Market update

Market update based on /ES & SPX

VST - Sell (based on current hourly chart)

ST - Buy (as of close yesterday)

IT - Buy (as of close yesterday)

LT - Sell

VLT - Buy

VST = hourly; ST = 4 hrly; IT = Daily; LT = Weekly; VLT = Monthly

These are my definitions, timeframes depends on volatility

Previous Gold update here . We are still nicely following the same trend, so I will post updates when trends change.

p.s: The earnings season is upon us. I would avoid earnings plays on individual stocks. I am not an earnings technician, I don't have the stomach for those gyrations. This is a nice time to trade the indices though, very manageable! Good luck!

Monday, March 24, 2014

Gold update

Gold is beautifully following in the footsteps of the chart I posted few weeks back. If you wish to read my comparison chart again, click here . Right now where we stand, Gold should be an excellent buy. This chance to buy will last this week and the next. Prices will absolutely take off on the upside from the week later. If you buy Gold at these levels, have a stop 3% below. Just in case!

Wednesday, February 19, 2014

Market update

Previous market update here

VST turned Bearish (previous bullish from DJI 15572) as of close right now

ST remains bullish from DJI 15694

IT remains bearish from 15879

LT Bullish

Monday, February 17, 2014

Market update

Previous market update here

VST - Bullish

ST - Bullish

IT - Bearish (from DJI 15879)

LT - Bullish

According to me,

VST = hourly charts

ST = daily charts

IT = weekly charts

LT = Monthly charts

I trade the ST but provide recommendations for all time frames

Monday, February 10, 2014

Market update

The market has turned to a ST buy at Friday close. The last sell netted ~ 862 DJI points (16462 - 15794).

VST - Buy

ST - Buy

IT - Sell

LT - Buy

Friday, February 7, 2014

Gold update

If you remember correctly, I predicted at the start of the year that Gold will fly into the 1500s before retreating to the bearish market. Many times in the past few months did Gold seemed that it would start a new bullish trend, but alas it keeps adjusting itself to the same area.

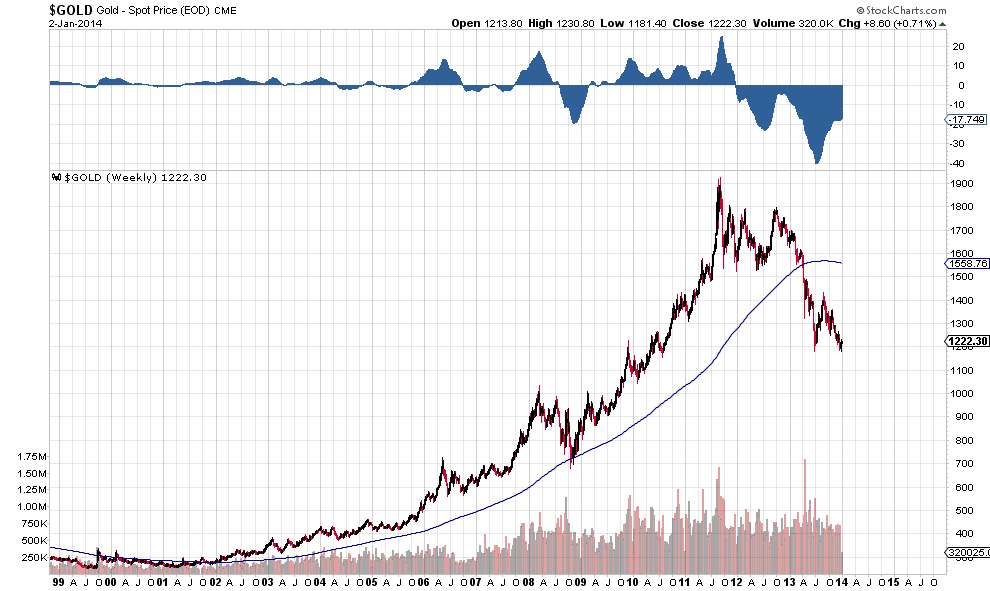

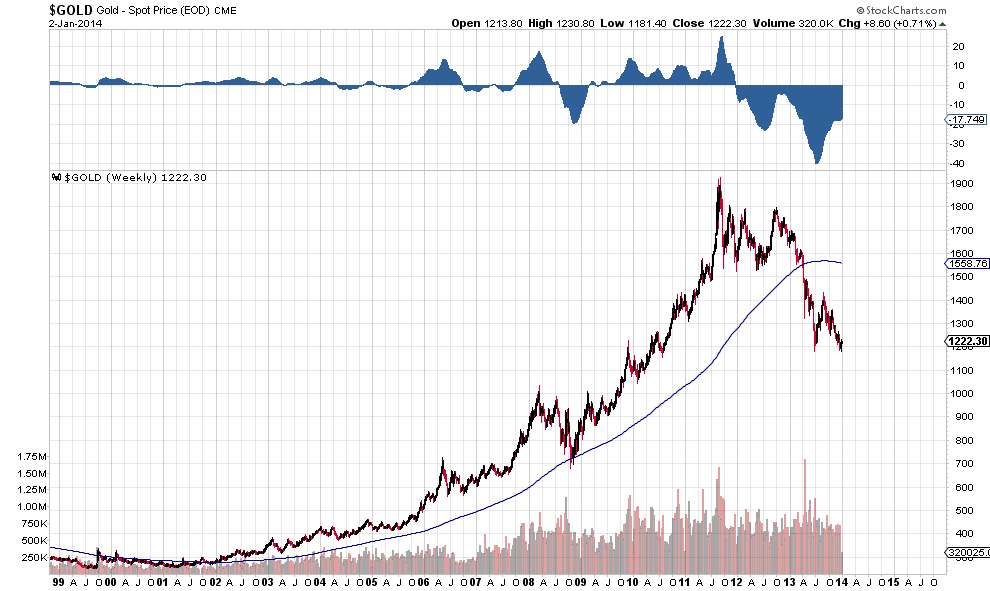

I was studying some past charts on yellow metal. I noticed something similar to the ongoing chart, albeit on a different time frame, you will see. During the techboom era, you can see that Gold formed a nice rounded bottom before zooming up. The price was tagging the (monthly) EMA 12 with a rounded bottom all along before spiking sharply higher into the next bull run.

I was studying some past charts on yellow metal. I noticed something similar to the ongoing chart, albeit on a different time frame, you will see. During the techboom era, you can see that Gold formed a nice rounded bottom before zooming up. The price was tagging the (monthly) EMA 12 with a rounded bottom all along before spiking sharply higher into the next bull run.

Look the weekly chart below:

I propose that the EMA 12 tagging will go on for the next few weeks. The breakout could be confirmed when the price crosses $1350, and then to ~ $1550. I will be happy to sit out this churn and chop before that.A double bottoms is in place. If you take a position now (aggressive investor!), have your stop below that W low.

JMHO

Sincerely!

Saturday, February 1, 2014

Market update

ST - Sell

IT - Sell

LT - Buy

While the decline this month has been steep, market held to the support (15675) last week. We could see a rally VST next week. I would not be a buyer of the rally till that ~ $DJI 16100 level (which is 61.8% of the decline from the top) is cleared. The 15675 level (= ~ SPX 1772) may be used as support/ resistance with stops by swing traders. I reckon swing traders dont need to trade/ open new positions between 15675 and 16100. Hold on to your trades between that level. While traders can use the same range to buy the low and sell the high of this range.

Wih such a clean support/ resistance levels, what is the need for indicators?

Thursday, January 2, 2014

Gold preview

Looking for a test of the blue line in the next 4 - 5 months........

ST - Bullish

IT - Bullish

LT - Bearish

Subscribe to:

Posts (Atom)